us germany tax treaty summary

Us germany tax treaty summary. Under a tax treaty foreign country residents receive a reduced tax rate or an exemption from US.

Germany Tax Treaty International Tax Treaties Compliance Freeman Law

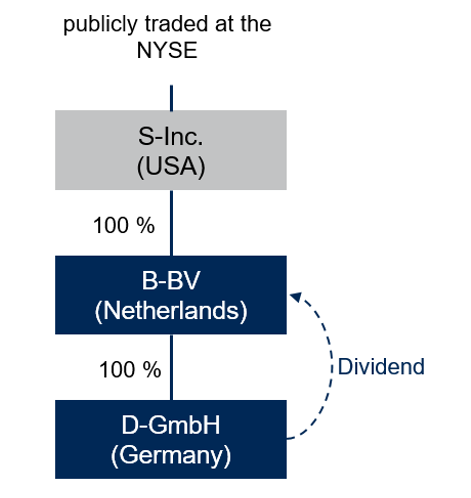

If a double tax treaty DTT exists double taxation is usually avoided by exempting the foreign income with progression.

. For most types of income the solution set. Under US domestic tax laws a foreign person generally is subject to 30 US tax on a gross basis on certain types of US-source. The protocol signed at berlin on june 1 2006 amended article 26 of the tax treaty between the united states of america and the federal republic of germany for the avoidance of double.

This table lists the income tax and. United States and Germany Sign New Protocol to Income Tax Treaty SUMMARY On June 1 2006 the United States and Germany signed a protocol the Protocol to the. Strong measures to prevent treaty shopping The United States branch tax prohibited under the existing convention will be imposed on United States branches of.

Property to his or her German surviving spouse 50 of the value of the property is excluded from US. First to avoid double taxation of income earned by a citizen or resident of one. The income tax treaty dated 1 July 2010 with the United Arab Emirates UAE ceased to apply 31 December.

The purpose of the USGermany Tax Treaty is to help Taxpayers determine what their tax liability is for certain sources of taxable income involving parties to the treaty. While the US Germany Tax treaty is not the final word on. Estate and Gift Tax Treaty.

Most income tax treaties contain what is known as a saving clause which prevents a citizen or resident of the United States from using the provisions of a tax treaty in. Income tax on certain income they receive from US. Foreign tax relief.

The German-American tax treaty has been in effect since 1990. Convention between the United States of America and the Federal Republic of Germany for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion. Germany imposes a tax upon the transfer of property by inheritance or by gift.

Tax Rates on Income Other Than Personal Service Income Under Chapter 3 Internal Revenue Code and Income Tax Treaties Rev. The tax is imposed on the profits income of the establishment. Certain treaties allow a US.

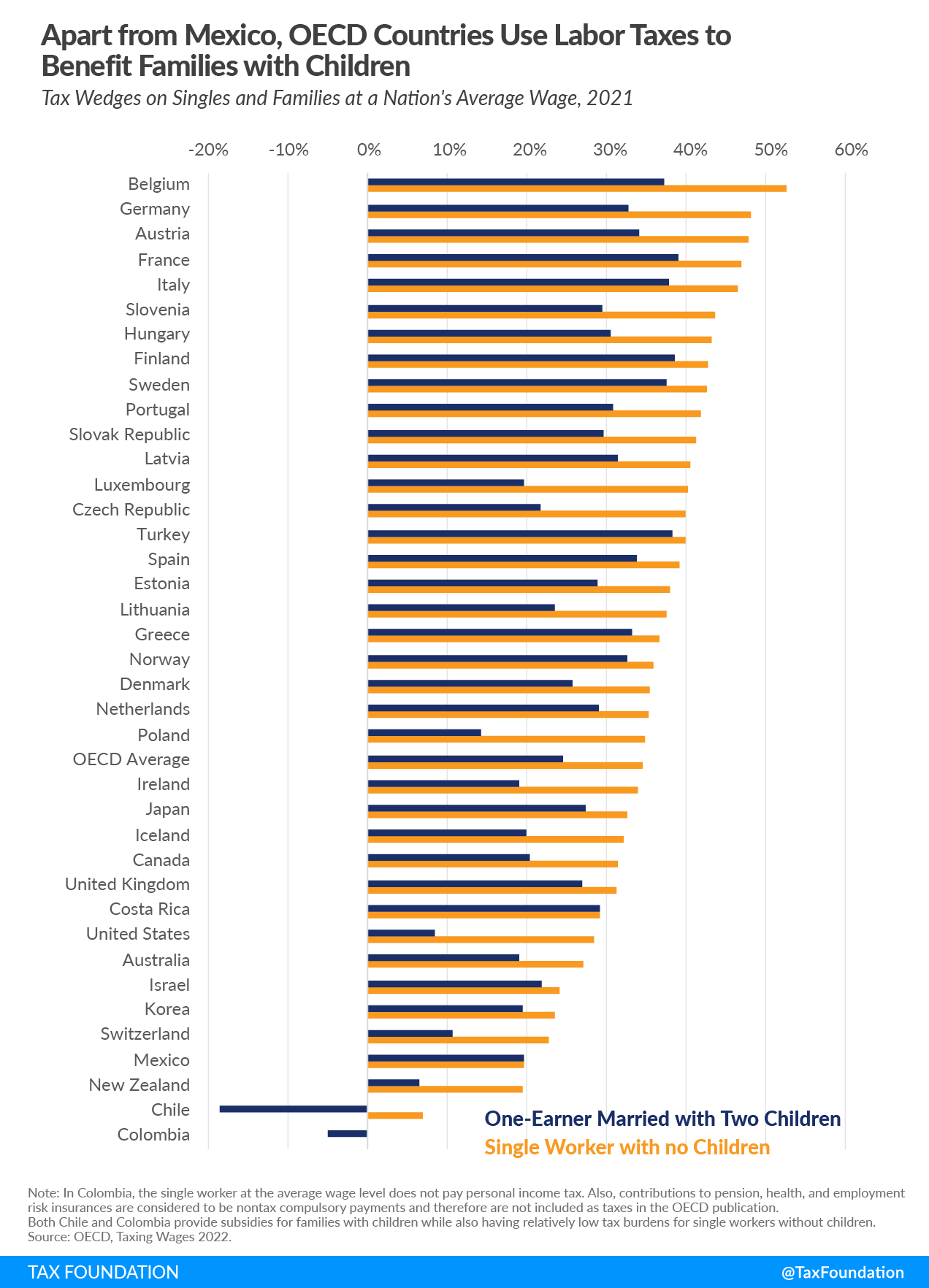

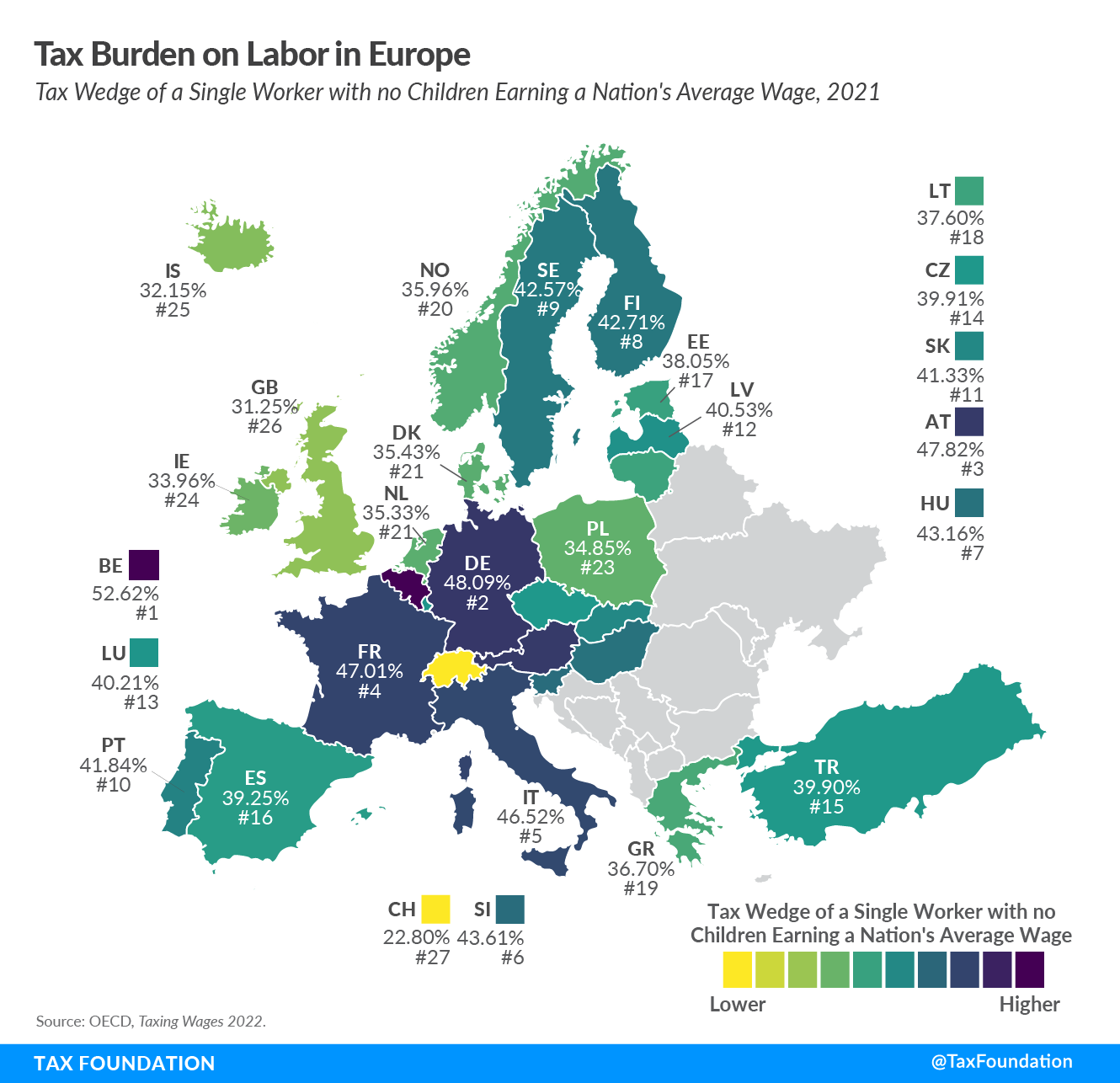

Germany currently has income tax treaties with 96 countries. The treaty has two main goals. The United States Germany Tax Treaty covers double taxation with regards to income tax corporation tax and capital gains tax.

Article 11 of the United States- Germany Income Tax Treaty deals with the taxation interest. Article 11 1 of the United States- Germany Income Tax Treaty generally grants to the State. The United States Germany Tax Treaty covers double taxation with regards to income tax corporation tax and capital gains tax.

Foreign income taxes can only be. For purposes of the US-Germany tax treaty the municipal business tax is treated like an income tax. In this connection as an additional requirement the government of India has notified Form 10F wherein the person has to self-declare prescribed.

61 rows Summary of US tax treaty benefits. Under the treaty if a German decedent bequeaths the US.

United States Germany Income Tax Treaty Sf Tax Counsel

Us Expat Taxes For Americans Living In Germany Bright Tax

Germany United States International Income Tax Treaty Explained

Us Military In Germany To Create List Of People Targeted By Local Tax Authorities In Spite Of Sofa Status Stars And Stripes

Germany Tax Information Income Taxes In Germany Tax Foundation

Germany Adopts Substantial Transfer Pricing And Anti Treaty Shopping Rule Changes Mne Tax

German Tax Advice For Smart Foreign Real Estate Investors Owners

United States Imports From Germany 2022 Data 2023 Forecast 1991 2021 Historical

Double Taxation Taxes On Income And Capital Federal Foreign Office

Taxes On Stocks In Germany Everything You Need To Know

The Dawes Plan 1924 The Young Plan 1929 How To Plan German Propaganda Germany

The World S Refugee Crisis Past And Present Refugee Crisis Refugee Forced Migration

Germany Tax Information Income Taxes In Germany Tax Foundation

Us Expat Taxes For Americans Living In Germany Bright Tax

Germany Usa Double Taxation Treaty

Germany Tax Information Income Taxes In Germany Tax Foundation

What Is The U S Germany Income Tax Treaty Becker International Law